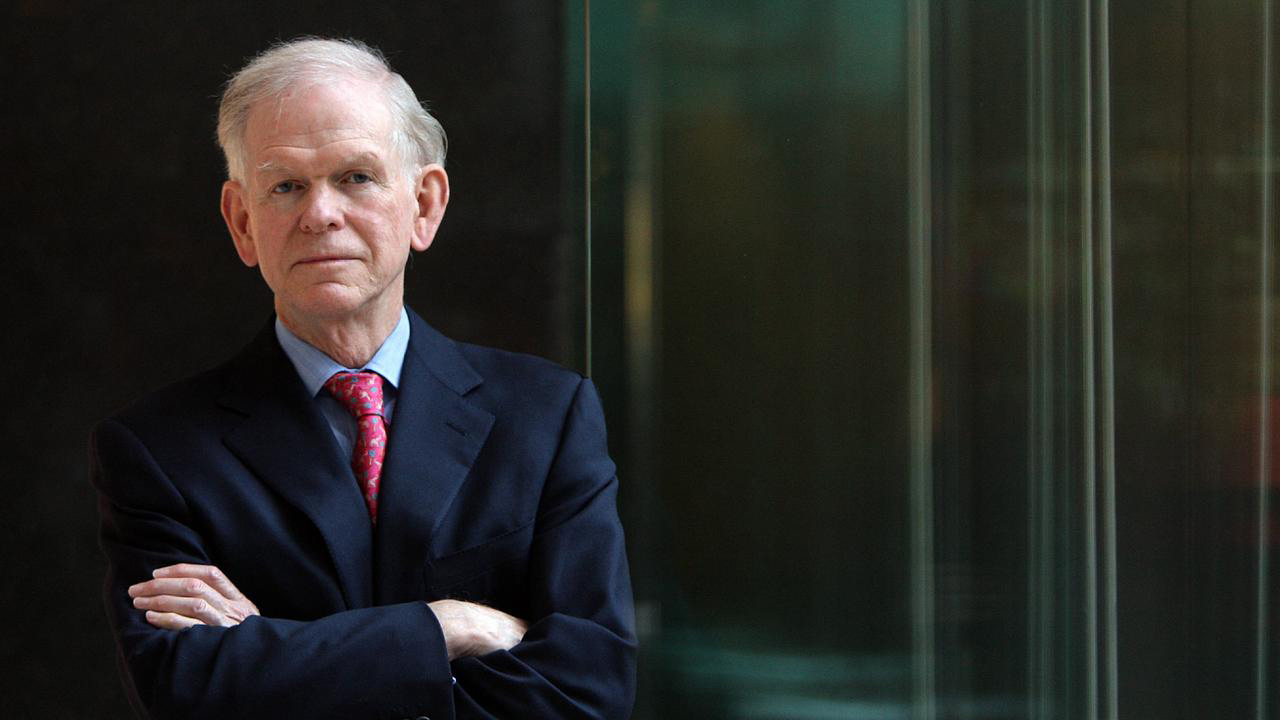

Doomsday: Jeremy Grantham warns ‘super bubble’ will soon pop, tanking stocks 50 percent

Markets are in the midst of a “super bubble” that could burst any time — and when it does, stocks will tumble by 50 percent, warns one of Wall Street’s most famed investors, who accurately called other recent financial collapses.

Jeremy’s post can be found here.

Jeremy Grantham, the 83-year-old founder of Boston-based money manager Grantham Mayo van Otterloo, points to a rapid run-up in “parody” cryptocurrencies like dogecoin and to huge gains in otherwise dumpy “meme” stocks like AMC and GameStop as examples of the out-of-control speculation that’s feeding the bubble.

“In a bubble, no one wants to hear the bear case,” he said in a letter to investors Thursday. “It is the worst kind of party-pooping.” Still, he’s making the case that the world is on course to a crash similar to those seen in the Great Depression of 1929, the dot-com bubble of 2000 and the financial crisis of 2008.

“Today in the US we are in the fourth super bubble of the last hundred years,” Grantham said, arguing that the S&P 500 index of the biggest US stocks could fall some 45 percent from its current levels. He didn’t put a time on when he expects the bubble to pop — only that markets are now in the late stages of a super bubble process that makes them vulnerable to a sharp decline at any time.

That pop could send the S&P 500 from its current levels of around 4,600 to 2,500, he said. The tech-heavy Nasdaq, which already has fallen more than 8 percent this month, will continue its spiral downward, he said.

Grantham said the worrying signs are the performance of speculative stocks like Ark Innovation ETF, which has fallen by some 52 percent since a year ago.

He also blames “crazy investor behavior” which includes meme stocks, the fascination with cryptocurrencies, and the rise in popularity of new technologies like NFT, or the so-called non-fungible tokens that are often digital copies of artwork.

“This checklist for a super bubble running through its phases is now complete and the wild rumpus can begin at any time,” Grantham said.

“When pessimism returns to markets, we face the largest potential markdown of perceived wealth in US history,” he said.

This article first appeared on the New York Post.

Author New York Post

Comment with GitHub

Newsletter

Jeremy Posts

-

-

Doomsday: Jeremy Grantham warns ‘super bubble’ will soon pop, tanking stocks 50 percent

Markets are in the midst of a “super bubble” that could burst any time — and when it does, stocks will tumble by 50 percent, warns one...

USA Posts

-

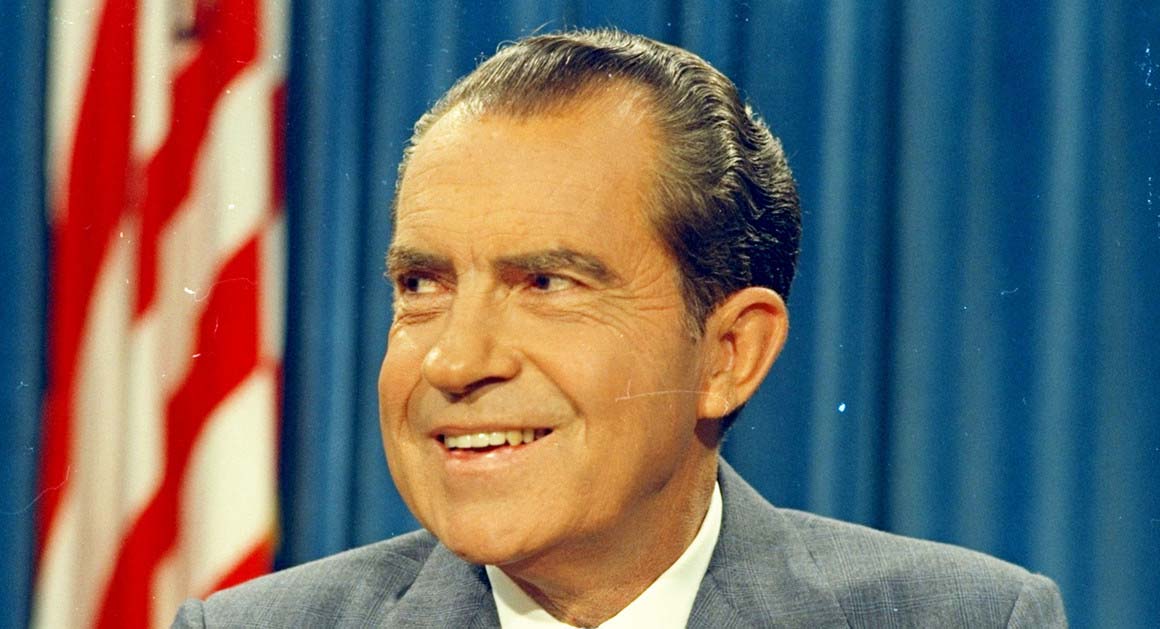

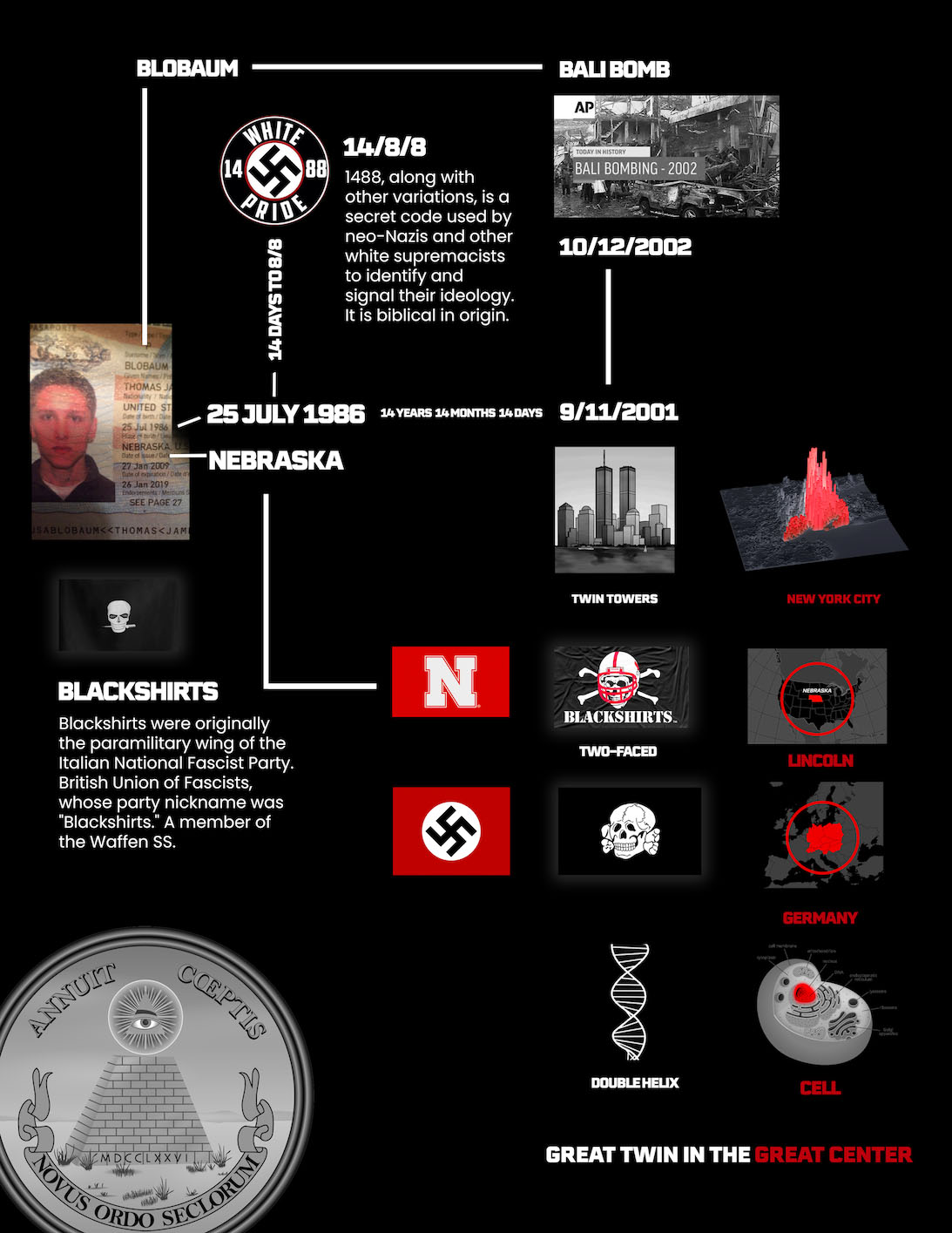

Blobaum is the dinosaur Of 1988

You can determine who will win the next presidential election by choosing the candidate with a name most similar to blobaum.

-

-

-

-

-

-

-

-

-

-

-

-

-

Doomsday: Jeremy Grantham warns ‘super bubble’ will soon pop, tanking stocks 50 percent

Markets are in the midst of a “super bubble” that could burst any time — and when it does, stocks will tumble by 50 percent, warns one...

-

-

-

Lincoln Man Behind Bars for Blackshirts Synagogue Graffiti Says Jewish Man Paid Him

LINCOLN – A 22-year-old Lincoln man convicted of a hate crime for spray-painting swastikas and racial epithets on a Lincoln synagogue,...

-

-

-

Latest Posts

-

-

-

-

Blobaum is the dinosaur Of 1988

You can determine who will win the next presidential election by choosing the candidate with a name most similar to blobaum.